The Stochastic Indicator shows where a security's price closed in relation to its price range over the specified time period. The percentage scale runs from zero to 100%. The stochastic values simply represent the position of the market on a percentage basis versus its range over the previous n-period sessions.

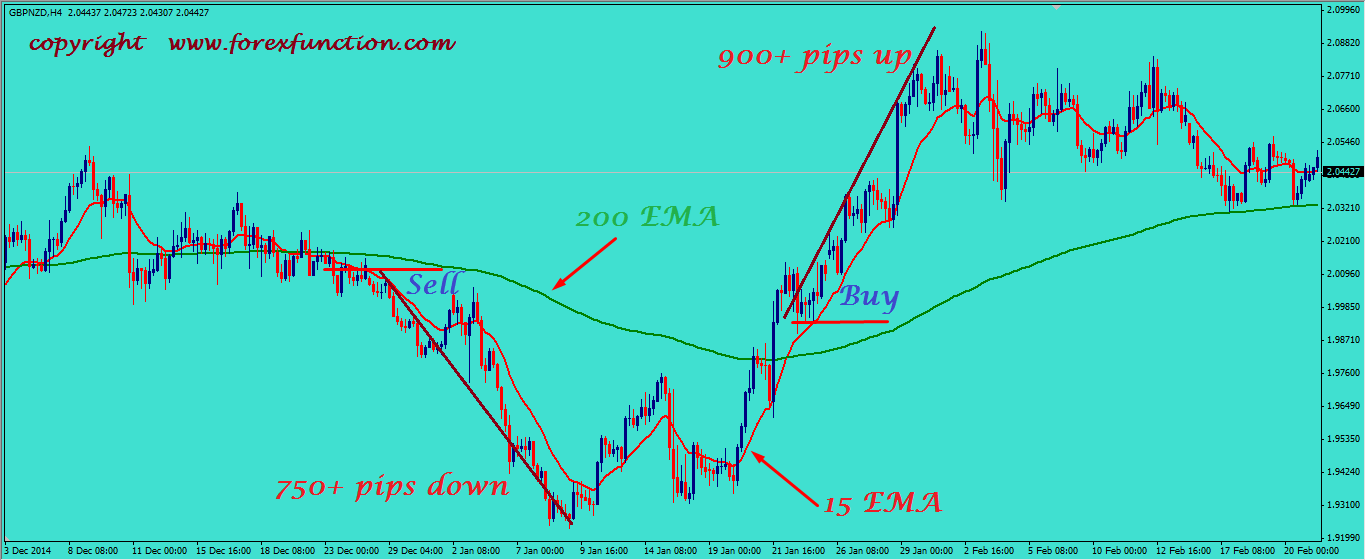

When a short-term moving average crosses above a longer term moving average, this indicates an upswing in the market. As well, when a moving average crosses below a longer-term moving average, the study indicates a down turn in the market. When the price falls below, it indicates a bearish commodity. When the price rises above the moving average, it indicates that investors are becoming bullish on the commodity. The effect of the moving average is to smooth the price movement so that the longer-term trend becomes less volatile and therefore more obvious. The moving average is used to observe price changes. For intraday data the current price is used in place of the closing price. The Moving Average is the average price of the security or contact for the Period shown. For example, a 9-period moving average is the average of the closing prices for the past 9 periods, including the current period.The Technical Analysis page contains the results of 12 common technical analytics over different periods of time.

0 kommentar(er)

0 kommentar(er)